Navigating the complexities of personal finance can be a daunting task, significantly for professionals juggling demanding careers and busy lifestyles. However, masterfully managing your finances is crucial for achieving long-term success. By implementing strategic financial habits, you can set yourself up for a secure and fulfilling future.

One of the primary steps in mastering your finances is establishing a comprehensive budget. This involves tracking your income and expenses to gain full understanding of your financial flow. By identifying areas where you can cut back spending, you can free up capital to allocate towards your financial goals.

Moreover, it's essential to prioritize investment. Aim to build an emergency fund that covers at least three months of living expenses to provide a safety net in case of unexpected events.

In tandem, explore various investment options to grow your wealth over time. This may include stocks, bonds, mutual funds, or real estate, depending on your risk tolerance and financial objectives.

Regularly assessing your budget and investment portfolio allows you to make necessary changes to stay aligned with your goals. Don't hesitate to seek advice from a qualified financial advisor who can provide personalized plans tailored to your unique circumstances.

Financial Planning Strategies for Career Success

Cultivating a successful career often requires more than just competent execution of your duties. Calculated financial planning can be a essential component to achieving long-term achievement in your chosen industry. By implementing sound financial habits and strategies, you can optimize your earning potential, mitigate risks, and create a solid base for a rewarding career journey.

- Explore your income streams and outlays.

- Create a financial plan that distributes funds to primary needs, investments, and enjoyment goals.

- Allocate your finances wisely to accumulate assets over time.

Moreover, stay aware about financial trends that can impact your career trajectory. Regularly review your financial plan and make adaptations as needed to ensure it accommodates your evolving professional goals.

Developing Wealth as a Professional: Key Steps & Tactics

Wealth building is a paramount goal for many professionals. While securing financial success requires consistent effort and strategic planning, it is certainly attainable with the proper approach. Here are some key steps and tactics to guide you on your wealth quest:

* Boost Your Income: Explore opportunities for compensation increases, take on side projects, or develop new skills that attract higher pay.

* Mindful Spending: Create a thorough budget to track your outlays and pinpoint areas where you can minimize spending without compromising your quality of life.

* Invest Wisely: Learn the fundamentals of investing and consider various asset classes such as stocks, bonds, real estate, or mutual funds.

* Plan for Retirement: Start saving for retirement early and consistently to guarantee a comfortable financial future. Explore different retirement accounts and consult with a financial advisor to create a personalized strategy.

* Continuously Educate Yourself: Stay informed about personal finance trends, investment strategies, and economic developments. Read books, attend seminars, or follow reputable financial sources.

By adopting these key steps and tactics, professionals can seize the reins of their financial future and cultivate lasting wealth.

Maximizing Returns for Affluent Investors

For high earners, investment portfolio optimization is paramount. Building a diversified asset base that aligns with your unique goals and risk tolerance is crucial. Factors such as revenue streams, estate planning, and future aspirations should all be carefully considered. A skilled financial advisor can help you navigate these complexities and develop a customized plan that sets the stage for long-term financial prosperity.

- {Consider professional guidance to ensure your portfolio is aligned with your specific needs.

- Regularly review and rebalance your portfolio to adapt to changing market conditions.

- Don't solely focus on short-term gains; prioritize long-term growth and financial security.

Professional Tax Management and Financial Planning

Pro fessionals often face complex challenges when it comes to managing their taxes. Effective financial planning is essential for maximizing assets and achieving long-term financial success.

A well-structured tax strategy should encompass various aspects, including asset allocation, insurance coverage, and portfolio diversification.

It's crucial for specialists to consult a qualified tax specialist who can provide tailored guidance based on their unique circumstances. A professional can help navigating the complexities of the tax system, optimizing tax burdens, and implementing a sustainable financial plan.

By implementing effective tax management strategies, professionals can ensure a brighter outlook.

Building Your Future: Retirement Planning for Professionals

Retirement planning is a vital step for professionals at any stage in their careers. It allows you to project your financial future and make informed decisions to ensure a comfortable lifestyle post-retirement your working years.

By utilizing a comprehensive retirement plan, professionals can maximize their savings capacity and mitigate financial risks. A well-designed plan ought to include diverse investment strategies, check here tax-optimized strategies, and consistent assessments to adapt to changing conditions.

In essence, retirement planning empowers professionals to achieve their financial goals and enjoy a fulfilling retirement.

Financial Legacy Essentials for Successful Individuals

Successful individuals frequently recognize the importance of comprehensive estate planning. A well-crafted plan not only protects your assets but also reflects your wishes regarding their distribution after your passing. By proactively addressing key aspects, you can avoid potential obstacles and provide financial well-being for your loved ones.

A cornerstone of estate planning is creating a last testament that clearly details your wishes for the distribution of your assets. Furthermore, evaluate establishing trusts to protect assets, potentially benefiting beneficiaries in a tax-efficient manner.

It is also essential to choose trusted individuals as trustees to carry out your wishes as outlined in your estate plan documents. Regularly reviewing your plan maintains its relevance in light of changing situations.

Consult experienced legal and financial professionals to craft an estate plan that addresses your specific needs.

Approaches for Managing Borrowings

Navigating the financial landscape as a professional can sometimes present challenges, especially when faced with accumulating obligations. Effectively managing these credit liabilities is crucial for achieving long-term well-being. A well-structured spending plan forms the foundation of any successful debt management strategy. Monitoring income and expenses meticulously allows you to identify areas where savings can be made. Consider prioritizing essential expenditures and exploring options for minimizing non-essential spending.

Developing a realistic debt settlement schedule is essential to regain control of your finances. Allocate a specific amount from each paycheck towards paying down credit card balances. Consider the APR rates associated with your liabilities and prioritize those with the highest rates.

Communicating with your creditors can often lead to more favorable agreements. Explore options such as lowering interest rates or setting up a remittance plan that aligns with your budgetary situation.

Seeking professional guidance from a debt counselor can provide valuable insights. They can help you assess your debt situation, develop a personalized strategy, and navigate the complexities of debt management.

Achieving a Balance Between Personal Finances and Professional Growth

Navigating the twists of personal finance while simultaneously pursuing professional advancement can feel like walking a tightrope. It requires careful consideration and a willingness to adjust your goals. Saving wisely allows you to create a stable financial foundation, while dedication to your career can lead to increased income.

Ultimately, finding the optimal balance is a individualized journey. It's about recognizing your own priorities and crafting a path that enhances both your financial well-being and professional ambitions.

Utilizing Financial Literacy for Career Advancement

Financial literacy isn't just about managing your personal finances; it's a valuable tool for career growth. Comprehending concepts like budgeting, investing, and debt management can greatly boost your financial well-being, which in turn can open doors career elevation.

When you exhibit strong financial literacy skills, you reveal responsibility and thoughtful planning, qualities that employers highly regard. You'll be better equipped to calculated decisions about your finances, which can minimize financial stress and allow you to focus more energy to your career goals.

- Additionally, strong financial literacy can empower you to discuss salaries and benefits more effectively.

- Consistently, investing in your financial education is an investment in your long-term success.

Cultivating Financial Awareness: A Path to Wealth and Serenity

In today's rapidly evolving financial landscape, it's more crucial than ever to cultivate a state of financial mindfulness. This involves adapting your mindset from one of scarcity to abundance and adopting mindful practices that cultivate financial well-being. With practicing financial mindfulness, you can attain both prosperity and peace of mind.

- Cultivating a deep understanding of your financial situation.

- Setting clear financial goals that align with your values and aspirations.

- Making mindful spending decisions that reflect your long-term financial well-being.

Financial mindfulness is not merely about storing money; it's about creating a holistic relationship with your finances that brings harmony. It's about thriving in alignment with your values and making conscious choices that direct you towards a life of both financial security and inner peace.

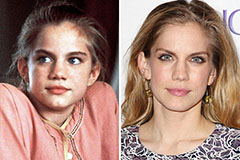

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Sam Woods Then & Now!

Sam Woods Then & Now! Sydney Simpson Then & Now!

Sydney Simpson Then & Now! Daryl Hannah Then & Now!

Daryl Hannah Then & Now!